Highlights – November 2025

Data visualization

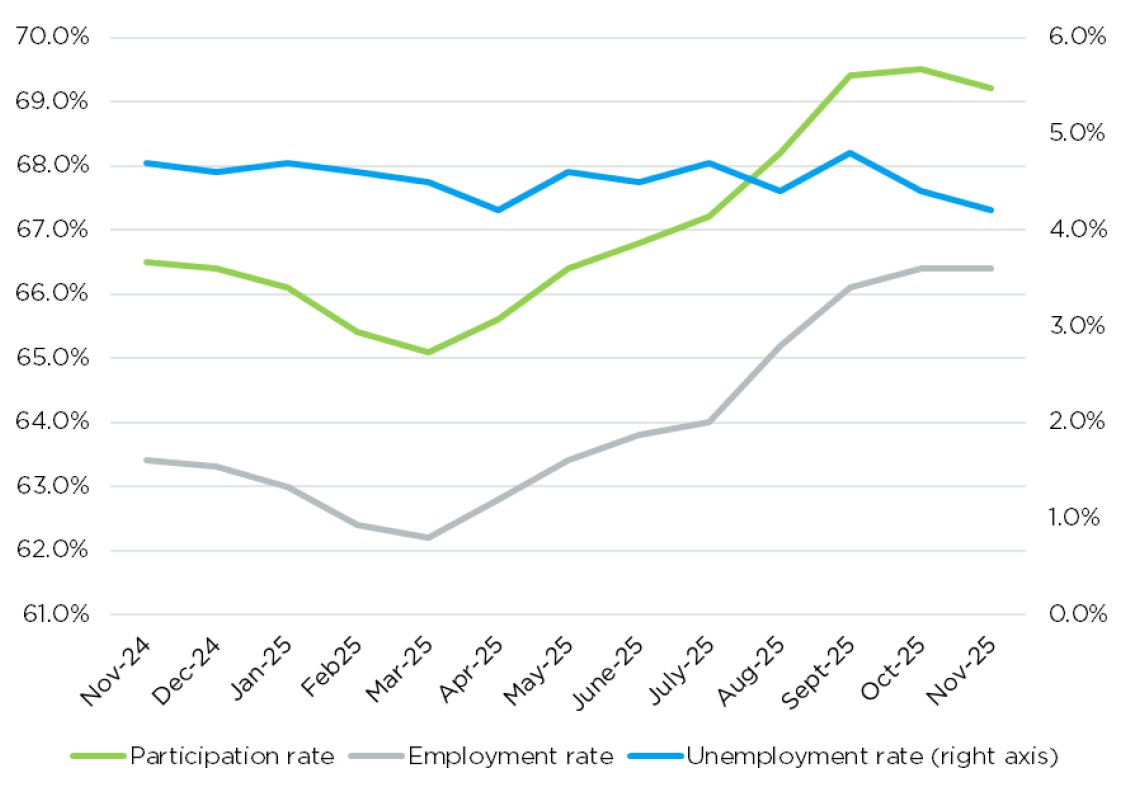

Evolution of the key employment indicators over one year

Sources: Statistics Canada, Table 14-10-0459-01, and Québec International.

Sources: Statistics Canada, Table 14-10-0459-01, and Québec International.

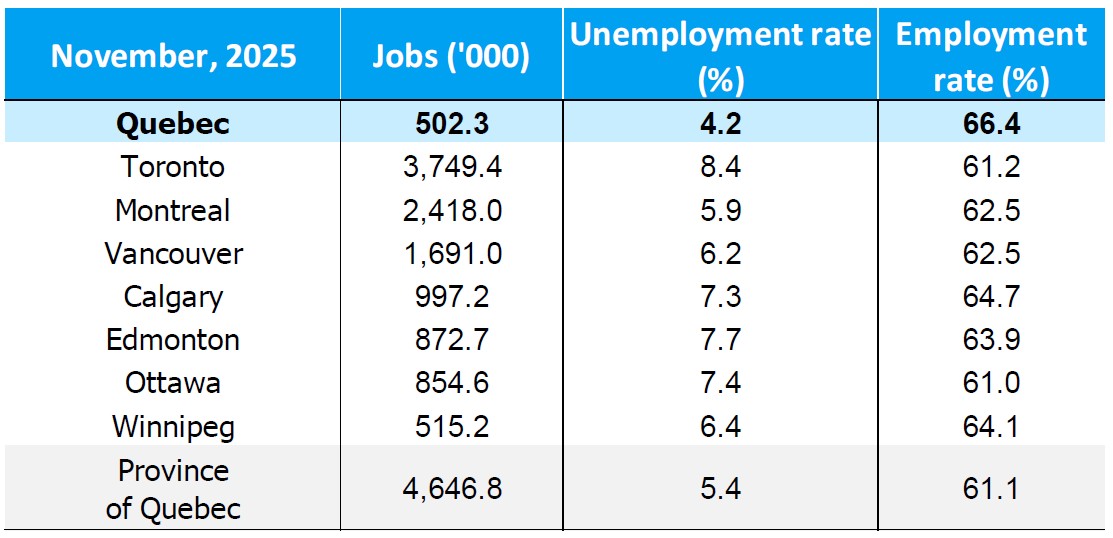

Overview of employment in major Canadian regions

Analysis

Slight downturn in employment in the Québec City CMA

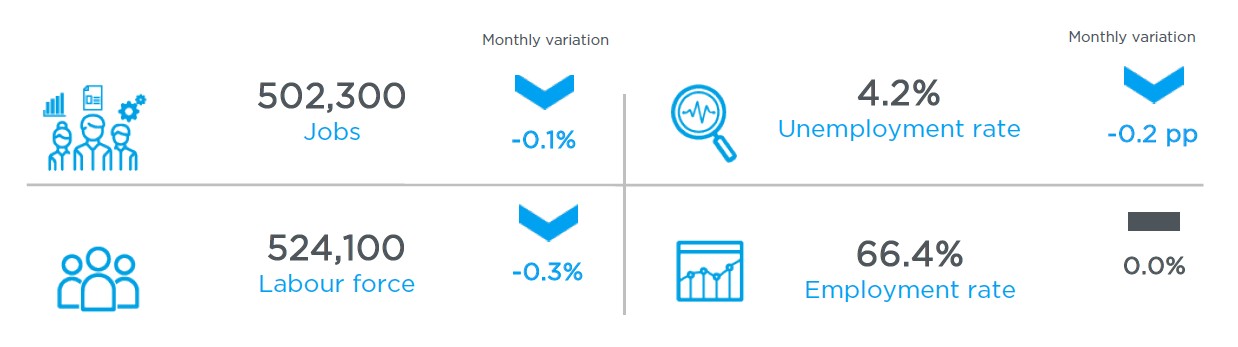

Based on Statistics Canada’s Labour Force Survey (LFS), there was a slight drop in the labour force in November 2025, with a net adjustment of 502,300 jobs (-0.1%) compared to the previous month. This situation is also reflected in other key indicators, as the labour force decreased by 524,100 individuals (-0.3%) and the employment rate remained stable at 66.4%. Yet, the region still stands out with a 4.2% unemployment rate, ranking third among all Canadian CMAs, behind Trois-Rivières (3.9%) and Victoria (4.1%).

At the Canadian and provincial levels, the labour market remained relatively stable. Employment was practically unchanged, with a negative variation of 0.3% in Canada and stability in the province of Quebec, while the unemployment rates showed modest fluctuations, settling at 6.8% (-0.2 pp) in Canada and 5.4% (-0.3 pp) in the province. This apparent stability reveals a somewhat fragile balance between the variations in the labour force and the pace of job creation, highlighting the need to take into account the specifics of each sector and age category in analyzing the labour market.

Major contrasts between sectors

In the current context, educational services (+5.7%) and accommodation and food services (+4.9%) registered the highest monthly increases, based on non-seasonally adjusted data. Many factors could explain the variation in accommodation and food services, including the beginning of festivities before the holidays. Conversely, manufacturing (-6.5%) and the information, culture and recreation sector (-6.3%) registered the strongest decreases, barring utilities.

Youth unemployment: enhanced vulnerability due to AI growth

The unemployment rate among the younger population (15–24 years old) was 7.8% in November, based on non-seasonally adjusted data, a drop of 0.6 pp from the previous month. This represents a significant improvement since September 2025, when the unemployment rate for this category peaked at 10.6%. Nevertheless, this metric remains a source of concern. The higher unemployment rate of those aged 15–24 compared to the overall population aged 15 and over is explained in part by structural factors, including the transition from school to work, the higher mobility of younger workers and the higher proportion of people working in temporary or seasonal roles. These factors are amplified by another significant challenge—the accelerated integration of artificial intelligence (AI) redefining the demand for skills. Although the effects cannot yet fully be measured in monthly data, some sectors with low complementarity and high exposition to AI are in a vulnerable position. According to the World Economic Forum (WEF), a high proportion of employers (40%) anticipate reducing their workforce where AI can automate tasks. However, it is worth noting that this transformation is accompanied by a reallocation toward functions with strong AI complementarity, which ultimately will promote job creation and productivity.

Rosalie Forgues

Economist

Québec International